Employee Benefit Plans

Protecting Your Plan, Supporting Your People

Administering an employee benefit plan (EBP) means navigating complex rules, evolving regulations, and high expectations from both regulators and participants. Whether you’re overseeing a 401(k), 403(b), defined benefit, ESOP, or health and welfare plan, consistent oversight is essential to protecting the integrity of the plan and supporting those who rely on it.

But determining if you need an audit and which type applies can be just as complex as managing the plan itself. Generally, plans with 100 or more eligible participants at the beginning of the plan year are required to undergo an annual audit. However, exceptions like the 80-120 participant rule, plan type, and ERISA status can all affect the requirements. Understanding where your plan stands isn’t always straightforward, and that’s just one reason why experienced guidance makes a meaningful difference.

When done right, the audit process becomes more than a compliance exercise. It strengthens fiduciary oversight, ensures proper documentation, and helps confirm that your plan is operating as intended. With increased scrutiny from the Department of Labor and IRS, a well-executed audit brings clarity, accuracy, and peace of mind.

Ensure compliance, minimize risk, and protect the future of your plan.

Employee Benefit Plan Audit Frequently Asked Questions

Generally, an audit is required for plans with 100 or more participants at the beginning of the plan year. However, exceptions such as the 80-120 participant rule, plan type, and ERISA status may affect the requirement, making it important to evaluate each plan’s specific circumstances.

Common plans that may be subject to audit include 401(k) plans, 403(b) plans, defined benefit pension plans, Employee Stock Ownership Plans (ESOPs), and health and welfare benefit plans. Audit requirements depend on plan size, type, and applicable regulations.

A properly executed audit enhances fiduciary oversight, verifies that the plan is operating according to its terms, and ensures that financial statements are accurate. It also helps identify potential errors, strengthens internal controls, and supports compliance with Department of Labor and IRS expectations.

ERISA Section 103(a)(3)(C) allows plan administrators to elect to instruct the auditor not to perform any auditing procedures with respect to the investment information prepared and certified by a bank or similar institution or by an insurance company that is regulated, supervised, and subject to periodic examination by a state or federal agency, and further that acts as trustee or custodian.

Effective audit preparation includes maintaining accurate participant records, ensuring proper documentation of plan transactions, and verifying compensation and deferral calculations. Experienced audit teams can assist with readiness reviews, self-corrections, and data analysis to streamline the process.

Employee Benefit Plan Audit Solutions

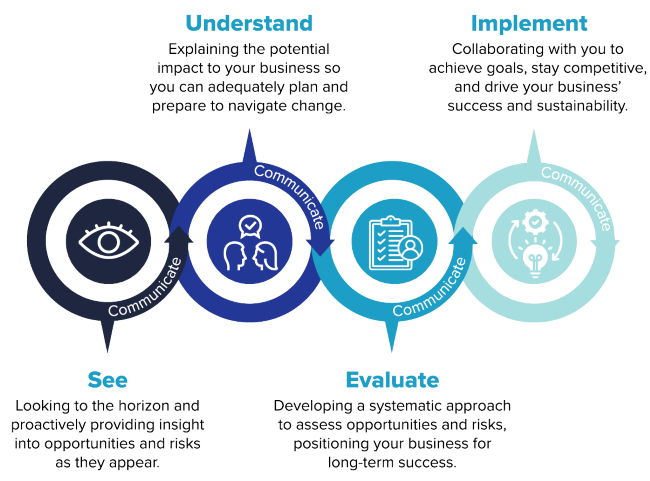

How Can We Help?

We offer a full suite of audit and consulting services to help you meet your EBP compliance obligations, improve plan administration, and stay ahead of regulatory changes. Key services include:

- ERISA Section 103(a)(3)(C) audits

- Non-ERISA Section 103(a)(3)(C) audits

- Audits for plans not subject to ERISA

- Financial statement audits for 401(k), 403(b), defined benefit, ESOP, and health and welfare plans

- Consultation on Department of Labor regulations

- Audit readiness consultations

- Compensation and participant deferral calculations

- Data extraction and analysis for DOL and IRS compliance

- Recommendations for improving plan administration

- Assistance with plan self-corrections

- Financial statement preparation

- Ongoing updates on regulatory changes