Choice of Entity Selection

Laying the Groundwork for Business Success

Choosing the right business structure is one of the most pivotal decisions you’ll make on your entrepreneurial journey. The structure of your business entity affects everything from your day-to-day operations to your long-term strategic plan. Whether you’re considering an LLC, S corporation, C corporation, partnership, or sole proprietorship, each option carries its own set of tax implications, legal protections, and administrative requirements. Your entity structure can evolve and change over time. You may be looking for the most tax advantageous structure, a setup to improve performance, or something that can be flexible as ownership changes. Making an informed choice in any situation means looking at your business through a multifaceted lens, considering how each structure aligns with your goals, industry practices, and growth trajectory.

Deciphering the Tax Implications

Tax considerations play a pivotal role in the entity selection process. Different structures have markedly different tax treatments, which will affect your bottom line, the complexity of your tax filings, and your capacity for attracting investment.

- Sole proprietorships: Ideal for small, low-risk businesses, these entities offer simplicity in operation and tax preparation. However, they also place your personal assets at potential risk and offer limited opportunities for tax planning.

- Limited Partnerships (LP): If ultimate flexibility in ownership and allocation of profits and losses is important to you, the pass-though entity is often the entity of choice. Complex tax regulations and filings can sometimes be a burden.

- Limited Liability Companies (LLC): LLCs provide flexibility and protection for your personal assets. Tax-wise, they can offer the pass-through benefit, but can also be taxed as C Corporations should that be desired. Limitations on investment opportunities and self-employment taxes should be considered.

- S corporations: This entity type combines the legal protection of a corporation with the tax benefits of a pass-through entity. This is a tax efficient structure often ideal for closely held corporations. Ownership options are limited.

- C corporations: Offering the most protection for owners’ personal assets, C corporations face double taxation on profits and dividends. However, they stand out for their ability to attract investors and support expansive growth.

Our goal is to demystify these options for you, highlighting the tax implications and how each choice aligns with your business goals.

ESTABLISH A ROBUST FOUNDATION FOR GROWTH, FLEXIBILITY, AND ENDURING SUCCESS.

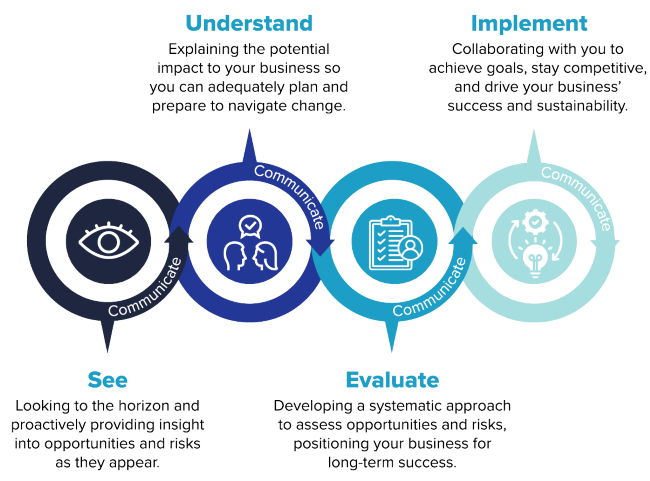

How Can We Help?

Ready to make an informed decision about your business structure?

As your business grows and evolves, our team provides continuous support, adjusting strategies to align with your changing goals. We guide you through tax considerations, from yearly compliance to long-term planning, to keep your business structure in tune with your ambitions. Explore our tailored services aimed at helping your business choose the right entity structure.

- Entity selection consulting

- Tax implication analysis

- Financial forecasting & modeling

- Legal and regulatory compliance

- Asset protection strategies

- Succession planning

- Entity conversion Support

Contact Us