Tax Compliance & Planning

Unlocking Opportunities for Growth

Effective tax management goes far beyond meeting deadlines and ticking boxes; done right, it’s part of an essential strategy for safeguarding and enhancing your financial health. The winding labyrinth of tax rules can seem daunting, filled with snares for established businesses, startup organizations, and individuals, alike. Yet, hidden within this complexity are valuable opportunities for savings and growth waiting to be uncovered.

Customized tax planning turns every tax decision into an opportunity to fine-tune your finances,

ensuring alignment with your long-term goals and paving the way for a thriving future. For businesses, this means strategically reinvesting tax savings to fuel growth and spur innovation. For individuals, it’s about leveraging deductions and credits to protect and grow your wealth.

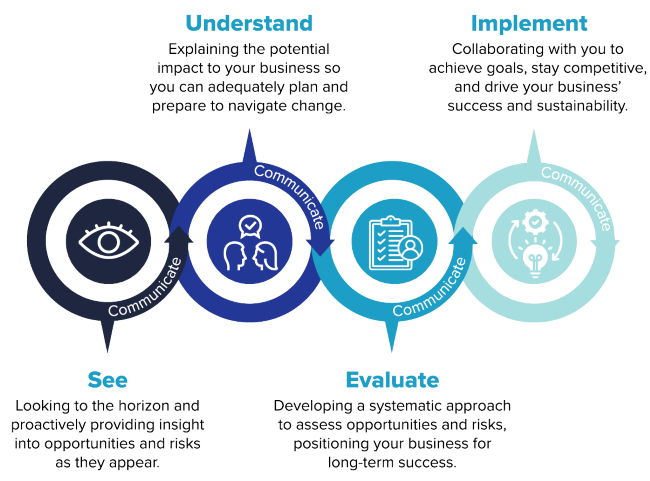

Constantly evolving international, federal, and state tax rules demand a proactive approach to your tax planning. By staying ahead of these changes, you can ensure compliance with current laws while freeing up resources, positioning yourself for strategic advantages.

MAXIMIZE YOUR FINANCIAL POTENTIAL WITH SMART TAX PLANNING.

How Can We Help?

Tax Compliance and Planning Solutions

Elevate your financial strategy with our all-encompassing services. If you’re seeking to optimize your finances and turn tax compliance into a competitive edge, we’re here to transform challenges into strategic opportunities.

Business Client Services:

- Tax compliance and planning

- Tax department outsourcing

- Tax provision calculations

- Tax examination and notices consulting

- Multi-state nexus analysis and planning

- Sales & use tax consulting

- State & local tax (SALT)

- Reverse sales and use tax audits

- Research & Development (R&D) tax credit studies

- IC-DISC

- Accounting methods review

- Cost segregation studies

- Tangible property regulations review

Private Client Services:

- Federal tax compliance and planning

- State tax compliance and planning

- Family business advisory services/family wealth check-up

- Wealth transfer planning

- Estate tax compliance and planning

- Household employee planning and payroll

Featured Team Members

Contact Us