Research & Development Tax Credit

Your Innovation, Supercharged

The research and development (R&D) tax credit is crafted to energize businesses at the forefront of innovation. Whether you’re developing standout products, streamlining your operations, or breaking new ground with technological advancements, this tax credit is aimed at significantly reducing your tax burden and elevating your business to new levels of success.

The scope of qualifying activities spans across sectors, including:

- Architecture

- Engineering

- Manufacturing & Fabrication

- Foundries

- Machining

- Tool & Die Casting

- And more

By applying a straightforward test, your projects can be assessed for technological innovation, problem-solving, and experimental development. If you’re pushing the envelope with innovation, you can secure the credit you deserve.

The Opportunity You Might Be Missing

Too many businesses leave this valuable incentive on the table, under the misconception that R&D Tax Credits are reserved for those with sprawling laboratories or groundbreaking patents. The reality is far more inclusive. Whether you’re refining an existing product, developing a new process, or simply experimenting with new materials or software, your efforts could qualify. This credit is about recognizing and rewarding the innovation that happens every day, not just the once-in-a-decade breakthroughs.

UNLOCK YOUR POTENTIAL FOR INCREASED TAX SAVINGS.

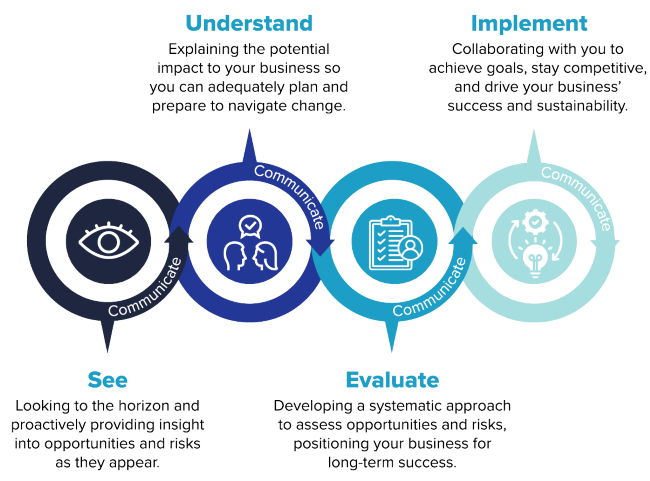

How Can We Help?

Ready to Transform Your R&D Spending into Savings?

We specialize in unlocking the full potential of the R&D Tax Credit for businesses like yours. Our expertise goes beyond simply identifying qualifying activities. We dive deep into your operations, uncovering opportunities to enhance tax savings and propel your business forward. With our guidance, you can transform your R&D spending into a strategic advantage, optimizing your tax efficiency and fueling growth.

Featured Team Members

Contact Us