SOC 1 Audits

Ensuring Your Financial Integrity - SOC 1 Reports

Are your financial controls truly secure and effective?

For service organizations handling financial data, SOC 1 audits are essential. These audits rigorously evaluate your internal controls related to financial reporting, ensuring your systems are secure and capable of producing accurate financial statements. By verifying the integrity and reliability of your financial controls, SOC 1 audits help you demonstrate a commitment to maintaining high standards and meeting regulatory requirements.

Who benefits from SOC 1 Type 1 and SOC 1 Type 2 audits?

Any service organization that impacts its clients’ financial reporting stands to gain. This includes third-party service providers, insurance companies, payroll processors, and trust departments. SOC 1 audits build trust with clients and stakeholders by proving that your financial processes are secure and reliable. They also help you meet contractual obligations and regulatory standards, reinforcing your credibility and competitive edge.

Why seek a SOC 1 Type 1 or SOC 1 Type 2 audit?

SOC 1 audits ensure that your internal controls over financial reporting are effective. Driven by client requests or regulatory demands, planning for a SOC 1 audit usually starts with a readiness assessment to identify and address control deficiencies early. This proactive approach pinpoints areas for improvement and ensures your organization is fully prepared for a successful SOC 1 audit.

Build trust and secure your financial integrity with SOC 1 audits.

SOC 1 Support for Internationally Based Companies Operating in the United States

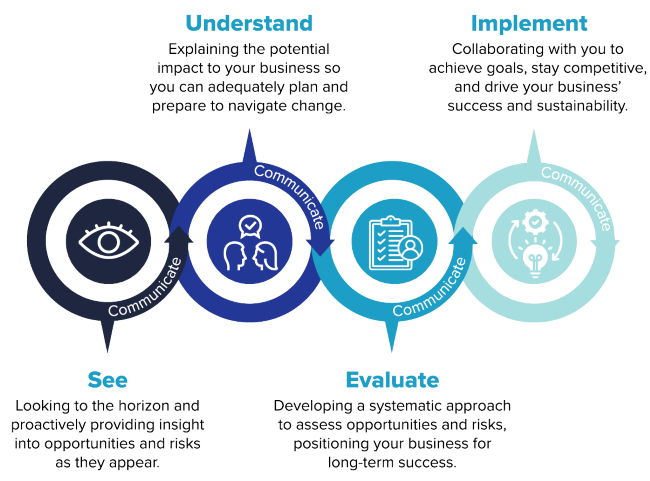

At McKonly & Asbury, we understand the unique challenges and responsibilities facing internationally owned companies operating within the United States. Our SOC audit services—ranging from SOC 1 and SOC 2 to SOC 3 and SOC for Cybersecurity—are tailored to support the needs of these businesses, providing scalable, efficient, and actionable solutions that help you stay secure, compliant, and trusted in today’s complex digital environment.

SOC 1 Frequently Asked Questions

SOC 1 audits evaluate a service organization’s internal controls over financial reporting (ICFR). These audits ensure that your systems are secure and capable of producing accurate financial reporting for the services which your customers use in their financial statements.

Any service organization that affects its clients’ financial reporting should consider a SOC 1 audit. This includes third-party service providers, payroll processors, insurance companies, and trust departments. These audits help build trust with clients and instill confidence in the financial information provided to them.

A SOC 1 Type 1 audit evaluates the design of your internal controls at a specific point in time (as of a specific date), while a SOC 1 Type 2 audit reviews the operational effectiveness of these controls over a defined period (usually 6-12 months). Since a Type 1 report only looks at control design, the Type 2 report provides your customers more confidence in your systems and processes as it looks at design and operations of controls over an extended period of time.

SOC 1 audits provide documented proof that your financial controls meet the control objectives important to your clients. A SOC 1 report may be required as part of certain contractual requirements.

Preparing for a SOC 1 audit typically begins with a readiness assessment to identify control objectives and controls that will be of value to your company and your customers, identifying any control weaknesses. This proactive step ensures your organization is fully prepared for a successful audit, addressing control gaps early in the process to guarantee the effectiveness of your internal controls over financial reporting.

SOC 1 Audits for Growth and Success

How Can We Help?

By leveraging our SOC 1 audits, conducted by independent auditors, you can ensure your internal controls are thoroughly evaluated and effective. These audits provide detailed risk assessments, identify control weaknesses, and offer tailored solutions to enhance your financial reporting systems. Learn more about our SOC suite of solutions offerings here: