Survey Says… Manufacturers Increase Optimism

Each quarter, the National Association of Manufacturers (NAM) releases the results of a survey which sheds light on manufacturers’ outlook over the next 12 months. The Q3 2025 results were released in September 2025, and were full of notable changes, including the following.

Overall Increased Optimism

As one would expect, the results of the Manufacturers’ Outlook Survey have been a rollercoaster during the first three quarters of 2025. After an eventful election season in late 2024, the first quarter of 2025 showed relative optimism amongst manufacturers. As tariffs began to dominate the headlines, the Manufacturers’ Outlook Survey showed nearly a 15% drop in optimism during Q2 2025. The latest survey results from NAM show an overall increase in manufacturer’s confidence from 55% in Q2 2025 to 65% in Q3 2025 responding positively. The results were even more optimistic for small and medium-sized manufacturers (i.e. between 50-500 employees), where 70% of respondents answered with an overall positive outlook for the next 12 months.

Top Business Challenge

Whereas the top business challenge faced by manufacturers in the post-COVID years have been dominated by “attracting and retaining a quality workforce,” that appears to have changed in 2025. Overall, manufacturers list “trade uncertainties” as the top business challenge over the past few quarters. For the past three years, trade uncertainty was ranked as the lowest of the challenges faced by manufacturers, but that changed drastically in response to tariff negotiations.

Worthy of mention is the fact that small and medium-sized manufacturers identified “rising health care/insurance costs” as their top business challenge, with trade uncertainties close behind.

Employment Outlook

The changes to the employment outlook over the next 12 months did not change significantly from Q2 2025 to Q3 2025. Manufacturer’s anticipate wage growth of 2.6% over the next 12 months, which has stabilized over the past couple of years. Lastly, over the past three years the surveys have consistently shown projected increased full-time employment between 1% – 2%.

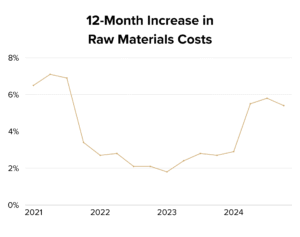

Raw Materials Costs

While a reduction in the expected raw materials costs is a welcomed change (5.8% increase in Q2 2025 to 5.4% increase in Q3 2025), manufacturers are still anticipating higher-than-normal cost increases over the next 12 months at a level nearly matching that of 2021. Keep in mind, those increased costs of raw materials in 2021 contributed to inflation being over 9% in the summer of 2022.

Artificial Intelligence

One final topic covered in the NAM survey was artificial intelligence and the impact of technology on manufacturers. The question, “Do you support President Trump’s announcement of permitting reforms to streamline project development for AI and related energy, grid and manufacturing products?” resulted in nearly 80% responding affirmatively, while less than 6% do not support the reforms. After breaking down the various elements of the permitting reform question further, there was greatest unity around “supporting the building of energy generation, infrastructure, and products” at 96%, while the lowest levels of agreement were around “using federal lands to site AI facilities and related projects” at 33%.

Any increase in optimism amongst manufacturers is a move in the right direction. While the overall survey results for Q3 2025 increased nearly 10% from the last survey, the industry is still about 9% below the historical average for the survey which dates back to the 1990s. After reading the survey results, it is clear that in order to get back to those historical average numbers for business outlook over the next 12 months, manufacturers are looking for more stability.

Please reach out to a member of our Manufacturing & Distribution team for more information on preparing for year-end inventory counts. For additional resources, visit our Manufacturing & Distribution industry page.

About the Author

Brett joined McKonly & Asbury in 2011 and is currently a Partner in the firm’s Audit & Assurance (“A&A”) segment. He is a leader in the firm’s manufacturing and distribution practice, while also serving clients in industries… Read more