State and Local Tax

Simplifying Complexity, Minimizing Risk

State and local tax obligations can quickly become overwhelming, especially as your business grows across city, state, and regional lines. The rules for income, sales, and use taxes are constantly changing, and no two states follow the same playbook. From determining nexus to tracking exemptions, the complexity often leads to missed opportunities, reporting errors, and increased audit risk.

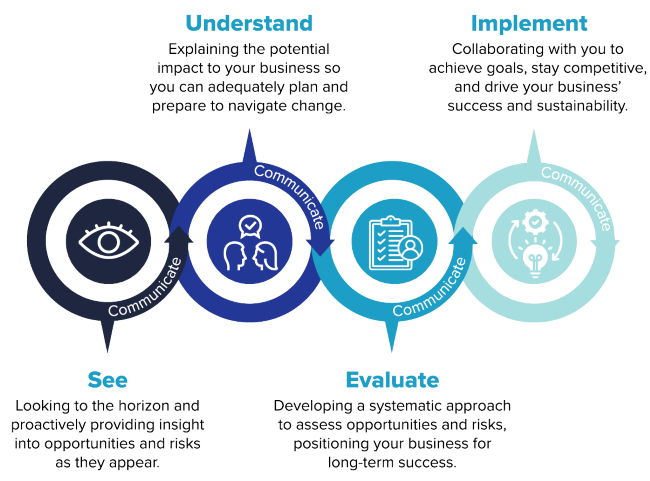

A proactive SALT plan helps you stay ahead. By analyzing your business operations across jurisdictions, you can better understand filing requirements, streamline compliance processes, and avoid costly penalties. A clear, step-by-step plan makes it easier to navigate complex tax rules and supports confident, informed decision-making.

With the right SALT plan, you’ll stop scrambling over surprise tax notices and stay ahead of potential risks. It’s time for clarity, control, and the freedom to focus on what matters most — growing your business.

Gain peace of mind with proactive SALT planning.

State and Local Tax Frequently Asked Questions

SALT stands for State and Local Tax, which includes income, sales, use, and other taxes imposed by various jurisdictions. As your business grows or operates across multiple states, understanding and managing SALT obligations is essential to identify savings opportunities, avoid penalties, stay compliant, and reduce audit risk.

Determining whether your business has a tax obligation in a state or locality depends on “nexus” — a connection between your business and a taxing jurisdiction. We conduct nexus studies to evaluate your business activities and identify where you are legally required to file.

Yes. Through sales and use tax reviews, we identify refund opportunities from past overpayments and recommend strategies to optimize future tax payments. We can also identify other tax savings opportunities through strategic state income tax planning. Our proactive approach can uncover significant savings and improve your compliance posture.

If your business faces an audit, we provide expert audit representation to guide you through the process. We help manage communication with tax authorities, compile documentation, and advocate on your behalf to minimize risk and disruption to your operations.

A proactive SALT strategy provides clarity on tax obligations and helps you make informed decisions when expanding to new states, hiring remote employees, or launching new products. With tailored guidance and planning, you can avoid surprises, reduce tax risks, and focus on growing your business.

State and Local Tax Solutions

How Can We Help?

Simplify SALT compliance and strengthen your business strategy. With proactive planning and tailored solutions, you can reduce tax risk, uncover savings, and make confident, informed decisions. Our SALT services include:

- Nexus Studies

- Taxability Determinations

- Sales & Use Tax Reviews

- Sales Tax Filing Services

- Voluntary Disclosures

- Audit Preparation & Representation

- Corporate & Pass-through Income Tax Consulting

- Abandoned & Unclaimed Property Compliance

- Local Business Privilege Tax Consulting