Sales Tax Filing Services

Accurate, Efficient, and Hassle-Free

Sales and use tax compliance is complex. Different states, cities, and counties follow their own rules, rates, and deadlines, turning a routine task into a time-consuming challenge. Without a clear strategy, even small errors can trigger penalties, audits, and hours of extra work.

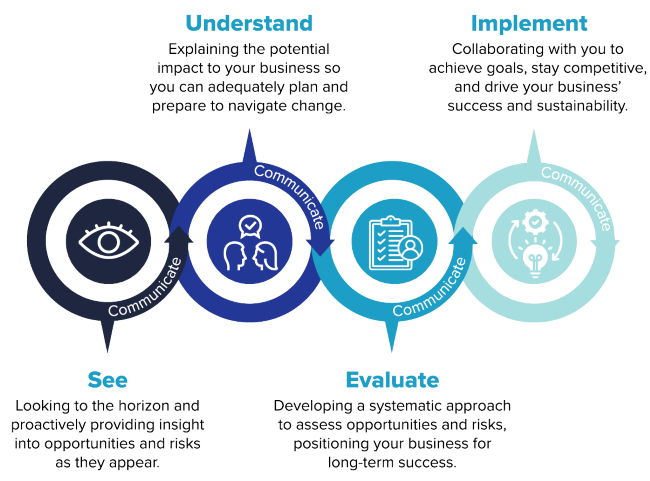

The right support makes all the difference. A proactive, year-round approach helps you stay ahead of changing requirements, ensuring taxes are calculated, filed, and remitted accurately. Regular reviews catch potential mistakes early, while clear documentation keeps you prepared if questions arise.

With proper guidance, you can stop second-guessing every return. From QuickBooks integrations to complex nexus determinations, a streamlined filing process saves time today and prevents problems tomorrow.

Spend less time on sales tax filings and more time growing your business.

Sales Tax Filing Solutions

How Can We Help?

Simplify sales and use tax compliance and strengthen your business strategy. With proactive planning and tailored solutions, you can reduce tax risk, uncover savings, and make confident, informed decisions. Our sales and use tax services include:

- State Registrations

- Portal Set Up

- Reminders & Notifications

- QuickBooks Assistance (QBO & QBD)

- Custom Rate Templates

- Avalara Implementation

- Cost-Benefit Analysis