Estate Planning & Administration

Protecting Your Family Legacy

Estate planning is deeply personal. You may be building your own plan or stepping in after a loss. In either case, the person responsible carries both the emotional weight and the responsibility to get it right.

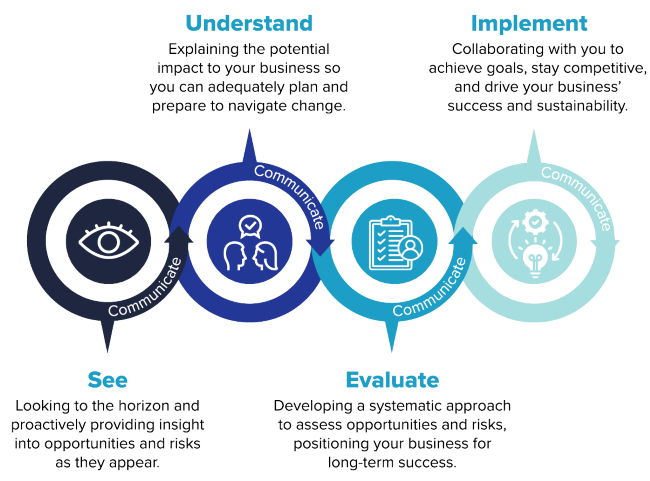

That’s where experienced guidance makes a difference. You gain a steady hand who manages, anticipates issues, and keeps every decision aligned with your intent. The tax impact is planned to avoid surprises, valuations meet IRS standards, and trusts remain in compliance. Your advisors work together so you always have clear answers when you need them.

With seasoned professionals guiding the process, you can focus on what matters most. You make informed decisions, ease the burden on others, and ensure the plan reflects your wishes from start to finish.

Gain peace of mind every step of the way.

Estate Planning and Administration Solutions

How Can We Help?

Whether you’re planning ahead or managing responsibilities after a loss, our solutions are designed to support your goals, reduce tax exposure, and keep the process moving smoothly. Key services include:

Tax Compliance and Filings

- Gift tax returns (Form 709)

- Fiduciary income tax returns (Form 1041)

- Tax elections and filing positions for estates and trusts

Valuation Services

- Valuations for estate and gift reporting

- Business interest transfers to family members or trusts

- Minority, controlling, voting, and non-voting interest valuations

- Real estate holding company valuations

- IRS-compliant reports prepared by credentialed professionals

Post-Death Administration Support

- Coordination with attorneys on trust setup and administration

- Trust compliance and annual reporting

- Accounting for business interests and other complex assets

- Document review and explanation of ownership structures

- Support for families navigating filings after loss

Advisory and Planning Support

- Collaboration with estate attorneys and financial advisors

- Ongoing tax impact analysis

- Projections of future estate and trust tax liabilities

- Guidance on entity selection for business succession