Nonprofit

Building Stronger Communities, Together

Nonprofit organizations are the heartbeat of thriving communities. Whether you’re addressing social issues, supporting education, providing healthcare, or advocating for the environment, your work shapes the fabric of society. But with this vital work comes the challenge of managing resources effectively, staying compliant with complex regulations, and ensuring your organization’s long-term financial health.

From small grassroots initiatives to established organizations, success is driven by more than just passion. It requires smart planning, strong financial oversight, and the flexibility to adapt to changing economic conditions. As regulations shift and donor expectations rise, securing the right financial guidance can empower your nonprofit to grow and maximize its impact.

Your mission to create lasting change and empower your community depends on building a strong financial foundation. With the right guidance, you can turn your challenges into opportunities for growth, ensuring that your nonprofit thrives while making a meaningful difference in the lives of those you serve.

Invest in the future of your nonprofit with a strong financial foundation.

Nonprofit Organizations Frequently Asked Questions

Nonprofit accounting places mission and stewardship at the center of financial reporting. Unlike for‑profit entities, nonprofits use financial statements designed to reflect accountability to donors, grantors, and the public. This includes the Statement of Financial Position (instead of a balance sheet), the Statement of Activities (instead of an income statement), the Statement of Functional Expenses (only for nonprofit organizations), and the Statement of Cash Flows. These statements emphasize net assets with and without donor restrictions, highlighting how resources must be used to advance your mission. In addition, there are certain mandatory disclosure items unique to nonprofits aimed at financial transparency.

Choosing the right level of service begins with understanding your organization’s funding environment, stakeholder expectations, and regulatory requirements. With that foundation in place, nonprofits typically rely on one of the following CPA engagements:

- Compilation – Presents financial data in the form of financial statements with no assurance.

- Review – Provides limited assurance, using analytical procedures and inquiries of management to determine whether financial statements require material modification.

- Audit – Provides the highest level of assurance (not absolute), including identifying and assessing risks of material misstatement, obtaining an understanding of internal control, and performing testing of significant transactions and balances.

For example, organizations soliciting contributions in Pennsylvania are required to provide certain financial statements along with their annual registration statement based on the amount of gross annual contributions.

A Yellow Book audit is performed under Government Auditing Standards and is required when funders, often governmental, expect additional rigor around ethics, independence, and compliance. In addition to meeting all financial statement audit requirements, a Yellow Book audit also includes additional reporting on internal control over financial reporting and on compliance.

Effective for fiscal years beginning on or after October 1, 2024 (i.e year-ends after September 30, 2025), a Single Audit is required when an organization expends $1,000,000 or more in federal awards during the year. A Single Audit includes all audit requirements under Generally Accepted Auditing Standards, Government Auditing Standards, and additional requirements around the evaluation and testing of internal control over compliance, and testing of compliance with major federal program requirements. The audit and financial statements must also include a SEFA (Schedule of Expenditures of Federal Awards) and there are additional reporting requirements, including filing a copy of the audit directly with the Federal Government.

Good grant management starts with disciplined tracking: Assistance Listing numbers, pass‑through identifiers, amounts received, allowable costs, procurement documentation, time‑and‑effort support, and subrecipient monitoring. Regular reconciliation between your general ledger and SEFA helps ensure completeness and accuracy for federal awards. Additionally, maintaining written grant policies and a centralized grant file helps ensure consistency, supports timely reporting, and reduces the risk of missing documentation during an audit.

Form 990 is more than a tax filing; it is part of your nonprofit’s public profile. It discloses your mission, programs, governance practices, compensation, fundraising activities, and financial results. A well‑crafted 990 strengthens trust, highlights your impact, and reinforces your commitment to accountability. It can also serve as a valuable marketing tool, showcasing the transparency and effectiveness of your organization.

Your Form 990 is due on the 15th day of the 5th month after your fiscal year‑end. For example, the 990 for an organization with a fiscal year end of December 31st is due May 15th. Organizations can obtain a 6‑month automatic extension using Form 8868. An extension also gives your team time to thoughtfully prepare narrative elements to highlight your impact in the community, as well as ensuring financial accuracy.

Restricted contributions must be tracked by purpose or time and recognized as restrictions are met. Conditional grants often require barriers to be overcome before revenue is recorded. In‑kind gifts require proper valuation and documentation. These treatments also influence how donors and grantors perceive your transparency, making proper classification essential for both compliance and relationship‑building.

Even with lean staffing, strong internal controls are achievable. Smaller nonprofits should focus on clear approval responsibilities, timely account reconciliations, documented financial procedures, and proper tracking of restricted grants. When full segregation of duties isn’t feasible, practical compensating controls, such as increased management or board oversight, can effectively mitigate risk. Simple, repeatable processes like monthly financial reviews, written authorization protocols, and system access controls can significantly strengthen oversight. The Board of Directors also plays a critical role, particularly for smaller organizations, by providing independent review and governance support to help ensure strong internal controls are consistently maintained.

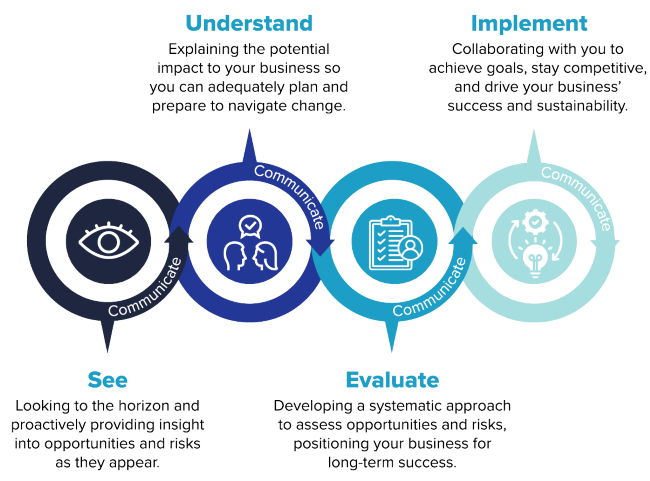

We provide understandable insights, walk through audit results, highlight emerging risks, and translate technical topics, like Uniform Guidance or revenue recognition, into practical governance actions. We also assist board members in interpreting financial information, understanding compliance responsibilities, and strengthening oversight practices so leadership can make well‑informed and strategic decisions. We also regularly consult with organizations, their management, and Board and provide training on a variety of topics.

Nonprofit Solutions

How Can We Help?

To help your nonprofit thrive, we start by understanding what success means to your organization. How you define success and the impact you aim to make in your community is what truly matters. We’ll work with you to turn that vision into reality. Explore our suite of accounting, tax, and consulting solutions, tailored to support nonprofits of all sizes:

Nonprofit Audit Services

- Financial Statement Audits

- Yellow Book and Single Audits

- Performance Audits

- Operational Audits

- Analysis of Internal Controls

Nonprofit Tax Services

- Tax Compliance and Planning Services

- Analysis of Activities for Unrelated Business Income Taxes

- State Registrations

- Representation before the IRS, Department of Revenue, or Other Taxing Authorities

- Sales Tax Exemption Filings

- Advising during the IRS Tax Exemption Application process

Nonprofit Consulting Services

- Business Transactions Consulting

- Financial Personnel Recruitment

- Technology Consulting

- Human Resources Consulting

- Assistance with Banking and Legal Relationships