Tax

A Strategic Approach for Long-Term Growth

Tax planning isn’t just about filing returns. It’s about optimizing cash flow, minimizing liability, and making informed decisions that support long-term success. Yet, for many individuals and businesses, the complexity of federal, state, and local tax laws makes it easy to overlook opportunities for savings and growth.

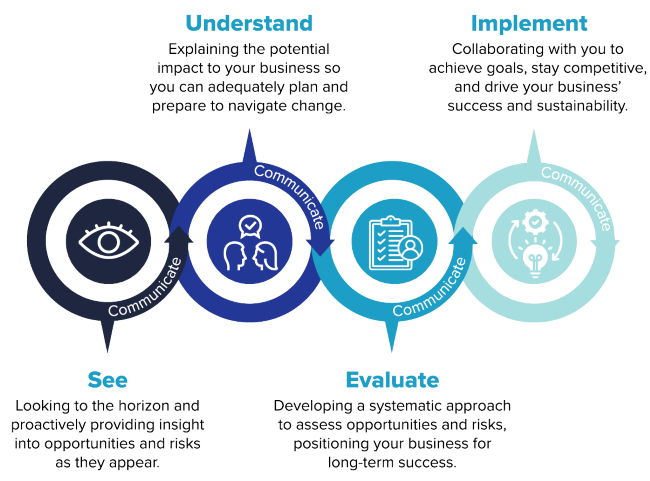

That’s where a proactive tax strategy makes a difference. By taking a big-picture view of your financial health, you can anticipate potential tax impacts and create a flexible plan that evolves with your goals. This approach helps businesses streamline operations and improve profitability while giving individuals clarity and confidence about their financial future.

With a comprehensive tax plan, you can move beyond reactive decisions and focus on what matters most — growing your business, securing your financial future, and preparing for what comes next.

Maximize savings, build momentum, and plan for the future.

Tax Compliance and Advisory Solutions

How Can We Help?

Elevate your financial strategy with our comprehensive tax services. Regardless of whether you’re an individual seeking to optimize your finances or a business looking to turn tax planning into a competitive edge, we’re here to transform challenges into strategic opportunities.

Business Client Services:

- Tax compliance and planning

- Tax department outsourcing

- Tax provision calculations

- Tax examination and notices consulting

- Multi-state nexus analysis and planning

- Sales & use tax review

- State & local tax (SALT)

- Reverse sales & use tax audits

- Research & Development tax credit studies

- IC-DISC

- Accounting methods review

- Cost segregation studies

- Tangible property regulations review

Private Client Services:

- Federal tax compliance and planning

- State tax compliance and planning

- Family business advisory services/family wealth check-up

- Wealth transfer planning

- Estate tax compliance and planning

- Household employee planning and payroll