Pennsylvania Nonprofit Reporting Thresholds May Rise with Pennsylvania House Bill 965 (HB 965)

BCO-10 Changes for Charitable Organizations

Many nonprofit organizations that solicit for public contributions within Pennsylvania are subject to reporting to the PA Bureau of Charitable Organizations (BCO) via the PA BCO-10 Annual Registration Statement. The BCO-10 requires additional supporting documentation, which varies based on the organization’s annual gross contributions received and statutory reporting thresholds.

Current PA BCO-10 Financial Reporting Requirements

Under current requirements, nonprofit organizations must file the following with the PA BCO:

- BCO-10 registration statement

- Complete and signed Federal form 990, 990EZ, 990PF, or 990N

- Internally prepared, compiled, reviewed, or audited financial statements

The first 2 requirements are standard for nonprofits; however, the third requirement is the one that can cause some hardship, especially for smaller nonprofits with limited resources.

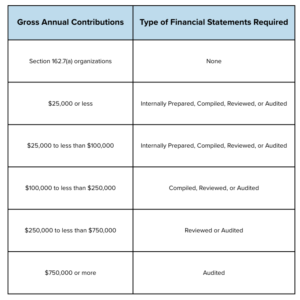

The following outlines the financial statements required by gross annual contributions.

Full BCO-10 instructions can be found on the Commonwealth of Pennsylvania’s website here.

Once a nonprofit organization reaches gross annual contributions of $100,000 or more, they need to include CPA prepared financial statements with the annual registration to comply with the regulations. CPA prepared financial statements may come in the form of a financial statement compilation, review, or audit. The cost of these attest services varies with the degree of complexity of the organization.

A compilation is the lowest level of service an independent CPA firm can provide. There is no assurance provided, meaning the independent CPA is not required to verify the accuracy of any of the information nor provide an opinion. The CPA is merely presenting management’s internal financial data in the form of financial statements. As annual contributions increase, reviewed or audited financial statements may be required to be submitted with the annual registration. This increase in scope of services requires the CPA to perform more procedures which requires more time, effort, and analysis. This translates into higher professional fees, a double-edged sword for growing nonprofit organizations.

Unfortunately, a dollar does not stretch as far as it did in 2015 – the last time the Single Audit thresholds were updated. In response to this, the Office of Management and Budget (OMB) issued an update in 2024, increasing the threshold for single audit requirements from $750,000 to $1,000,000 in annual expenditures of federal awards. The BCO followed this increase from the OMB by proposing an increase to match the audit threshold in 2017 which took effect in February 2018. Now that new Single Audit thresholds are in effect, there is a push in PA to increase the current requirements to match the OMB’s threshold again. For more information on Single Audits, find additional M&A Insights here.

HB 965 Proposed Thresholds: Relief for PA Nonprofits

During March of 2025, several PA representatives sponsored House Bill 965 (HB 965), which aims to align BCO reporting thresholds with the recently updated Single Audit thresholds discussed above. At the heart of HB 965, however, is more than just an increase to the audit threshold – it also proposed broadened adjustments to modernize reporting requirements for nonprofit organizations. This is good news for smaller organizations with very limited resources.

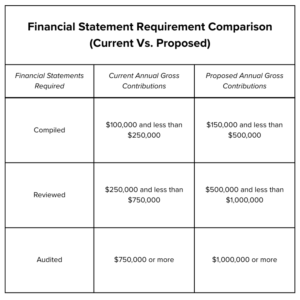

Below compares the current thresholds to those proposed.

As laid out above, the lower limit for compiled financial statements has increased $50,000, which means that those organizations with less than $150,000 in annual gross contributions could submit internal financial statements in lieu of CPA compiled financial statements. More notable is the fact that the upper limit is proposed to double. This would mean that nonprofits that are currently engaging a CPA firm to provide a review over their financial statements may be able to step down to a compilation if their gross contributions are under $500,000, instead of the current $250,000 and so forth. Nonprofits should consider their historical gross contributions and how these proposed changes could impact their organization. Reduced expenditures on attest services means more resources available to advance the organization’s mission.

Where Is HB 965?

Currently HB 965 remains with the House State Government Committee awaiting a vote to report out to the House floor. The link above to HB 965 provides a tracker to stay up to date with the Bill’s status and history.

Final Thoughts

Some nonprofit organizations may find themselves receiving an unexpected bequest that pushes annual contributions above their typical thresholds. This results in needing a higher level of attest services during certain years, which translates to additional cost and stress for organizations unaccustomed to that level of reporting or oversight. While the waiting game plays out, be sure to continually monitor contributions and maintain open communication with the organization’s external accountant to ensure the organization remains in compliance with the regulations. Having proactive discussions may prevent unexpected expenditures and avoid unnecessary penalties.

Please contact us if you have questions about the information outlined above; our seasoned and experienced Nonprofit professionals are here to help. You can also learn more about our Nonprofit services by visiting our Nonprofit industry page, and don’t forget to subscribe to M&A’s Nonprofit Insights to keep apprised of all the latest developments impacting nonprofit organizations.

About the Author

Chad is an Assurance Manager with extensive experience serving nonprofit organizations along with manufacturing & distribution as well as architecture, engineering and construction. He provides audit, assurance, and advisory… Read more