FAR Compliance: Audit and Consulting Services

Achieve Compliance, Maximize Opportunities

Securing federally or state-funded contracts means complying with Federal Acquisition Regulations (FAR), AASHTO, and GAGAS (Yellow Book) Standards. Federal agencies such as the Federal Highway Administration (FHWA), as well as state DOTs, require overhead rate submissions, cost allocations, and financial controls that stand up to audit scrutiny. Missteps can lead to disallowed costs, reduced reimbursements, or failed prequalification which jeopardize contract opportunities.

An effective overhead audit provides an independent review of your indirect cost rates, accounting systems, and internal controls to ensure compliance with FAR 31. This process verifies that overhead costs are accurately classified, allowable under FAR, and properly allocated. This can help your firm avoid costly audit findings and maintain eligibility for government-funded work.

In addition to our audit services, we also offer comprehensive FAR (Federal Acquisition Regulation) consulting. Our FAR consulting helps your organization develop policies and procedures, optimize cost recovery, and effectively prepare for agency oversight. From accounting system reviews to executive compensation analysis, the right guidance ensures your firm meets regulatory requirements while improving financial efficiency.

Navigate FAR compliance with confidence and focus on growth.

FAR Audits Frequently Asked Questions

Securing federally or state-funded contracts often requires compliance with Federal Acquisition Regulations (FAR). Failure to comply can result in disallowed costs, reduced reimbursements, or even failed prequalification, putting valuable contract opportunities at risk. Ensuring compliance through audits and consulting helps your organization avoid costly mistakes and stay eligible for government-funded projects.

A FAR overhead audit provides an independent look at your indirect cost rate calculations, accounting systems, and internal controls to ensure compliance with FAR. The audit helps ensure that overhead costs are classified correctly, allowable under FAR, and properly allocated. This process helps your firm avoid audit findings, maintain eligibility for government contracts, and optimize your cost recovery.

Our FAR consulting services provide expert guidance to help your organization develop policies and procedures that align with FAR and AASHTO. We assist with accounting process reviews, executive compensation analysis, and the creation of compliant cost allocation practices. Proactive consulting ensures you meet regulatory requirements and are always audit-ready, streamlining compliance and improving financial efficiency.

FAR Audit & Consulting Solutions

How Can We Help?

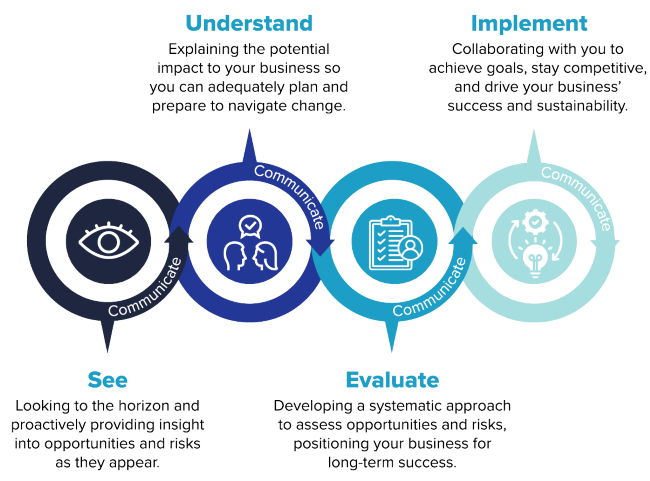

Transform your FAR audit into a building block for your organization’s growth strategy. Our solutions and insights help firms reduce risk, protect profitability, and gain a competitive advantage in government contracting.

FAR Overhead Audits

- Accounting system and internal control reviews

- Overhead rate calculation (indirect cost rates)

- Executive compensation review and analysis

- Audit preparation and support

FAR Overhead Consulting

- Policies and procedures development

- Indirect cost rate strategy

- Pre-award and incurred cost submission (ICS) reviews

- Year-round compliance support