Sales and Use Tax Review

Strengthen Compliance, Reduce Risk

Sales and use tax compliance is complicated. With varying rules, rates, and deadlines across states, it’s easy to overlook key details. From determining taxability to tracking multi-state sales, small errors can go unnoticed until an audit or penalty brings them to light.

For many businesses, the biggest challenge is knowing where they stand. Have you missed tax payments in states where you’ve established nexus? Are you overpaying on certain purchases or under-collecting from customers? It’s often challenging to know if you’re paying the right amount or if a hidden liability is quietly growing in the background.

That’s why a sales and use tax review can be so valuable. This review provides an in-depth analysis of your tax practices to uncover errors, potential refunds, and areas of exposure. If issues are found, the review offers a path to compliance, often anonymously, while reducing penalties and minimizing the look-back period.

Take the guesswork out of sales and use tax compliance with a customized review.

Tax Review Solutions

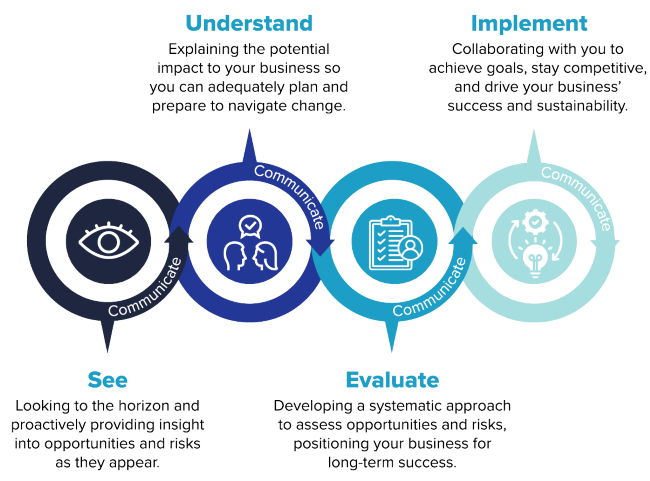

How Can We Help?

Simplify sales and use tax compliance and strengthen your business strategy with a customized review. With proactive planning and tailored solutions, you can reduce tax risk, uncover savings, and make confident, informed decisions. Additional tax services include:

- State Registrations

- Portal Set Up

- Reminders & Notifications

- QuickBooks Assistance (QBO & QBD)

- Custom Rate Templates

- Avalara Implementation

- Cost-Benefit Analysis